Financial wellbeing for every frontline employee

Empower your people through financial wellbeing management - built around pay, proven by data, backed by charities.

"It’s very simple to operate from both an end user and administrator perspective. Our employees have reported better financial health, reduced stress, and fewer needed trips to payday loan providers. It’s great to use as both a retention and recruiting incentive."

Brad McGerald, Director, HR Ops Services

Offered by

award-winning employers

A complete financial wellbeing program

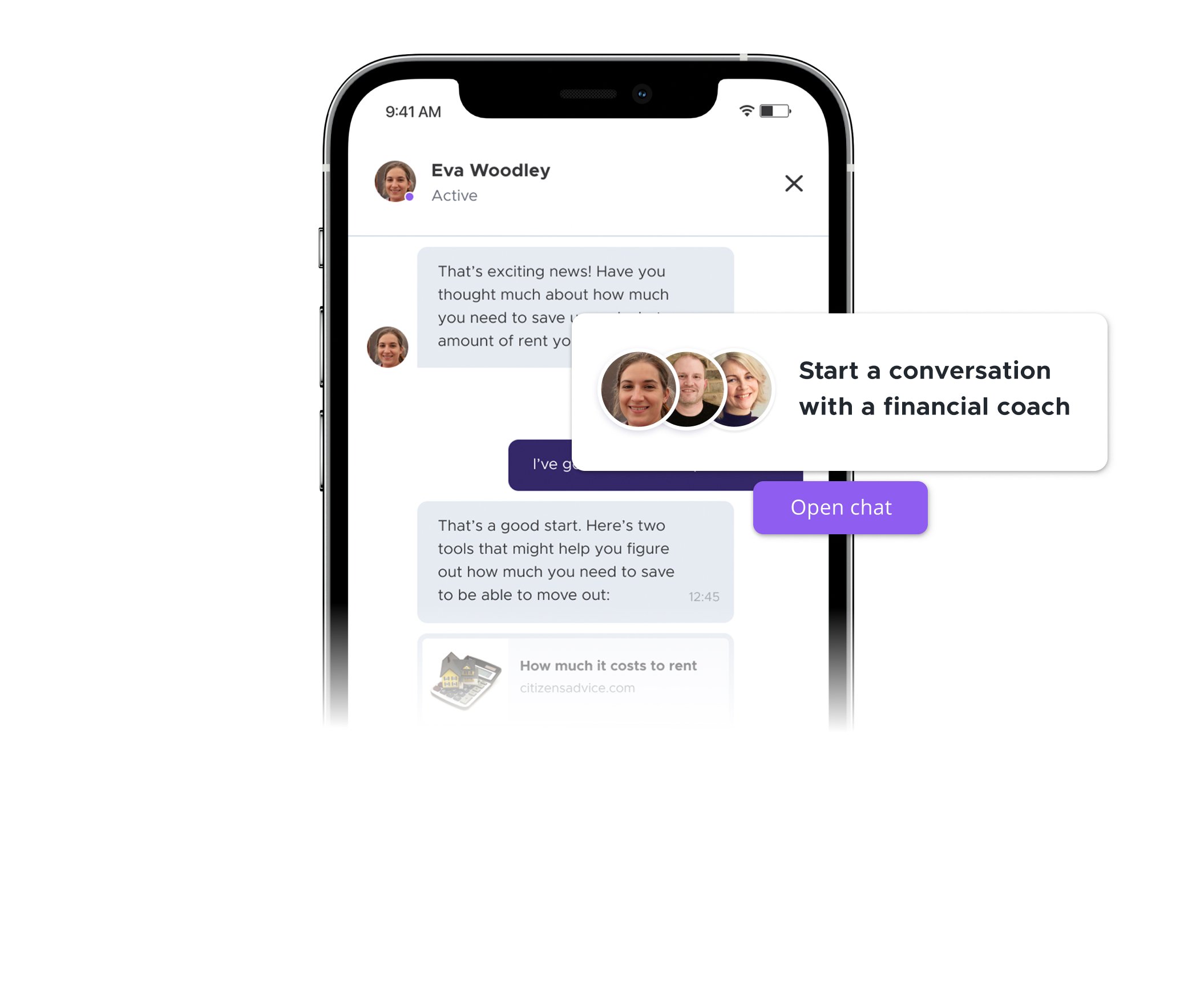

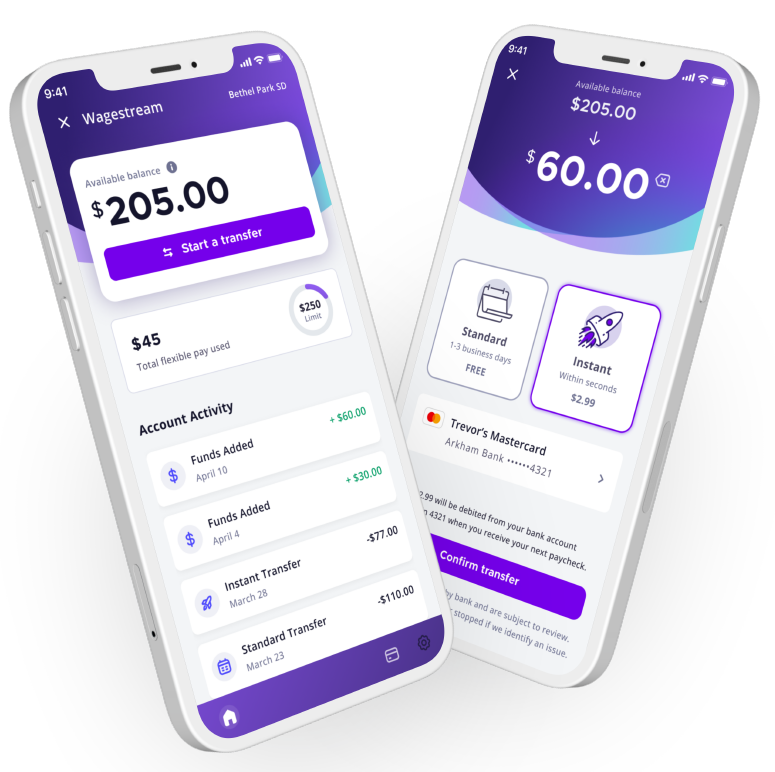

With one app for your team, and one portal to manage everything.

Mission-driven, charity backed

The only financial wellbeing platform built by charities, proven by data and accountable for improving quality of life.

Built with impact experts

Founded by, and accountable to leading social impact charities, with a binding social charter so we always focus on improving individual wellbeing.

Proven by data

We work with independent research partners to track and improve the impact of Wagestream on your organization.

Accountable by design

Our social charter means we only build products that improve financial wellbeing and we measure the impact on your team's quality of life.

Your biggest challenges, solved

Our financial wellbeing app delivers business impact

27%

decrease in time-to-hire

“This is a real revolution in pay that is making it easier to recruit staff.”

Tim Painter

HR Director

16%

reduction in turnover

“The ability to retain staff is already paying dividends for us as a business.”

Claire Clark

Group HR Director

26%

increase in shift fill rate

“This has had a positive impact with staff volunteering for extra shifts.”

David Reed

HR & Compliance Manager

At Wagestream, our members are at the center of what we do. We invited some of our members to share their stories with us about their money worries and financial challenges and how Wagestream has helped them manage these and their money better day-to-day.

Join hundreds of organizations transforming financial wellbeing with Wagestream.

.png?width=206&height=70&name=RH%20Small%20logo%20(2).png)